U.S. Next Generation Sequencing Market Intelligence, Revenue Expansion, Key Players and Long-Term Growth Signals

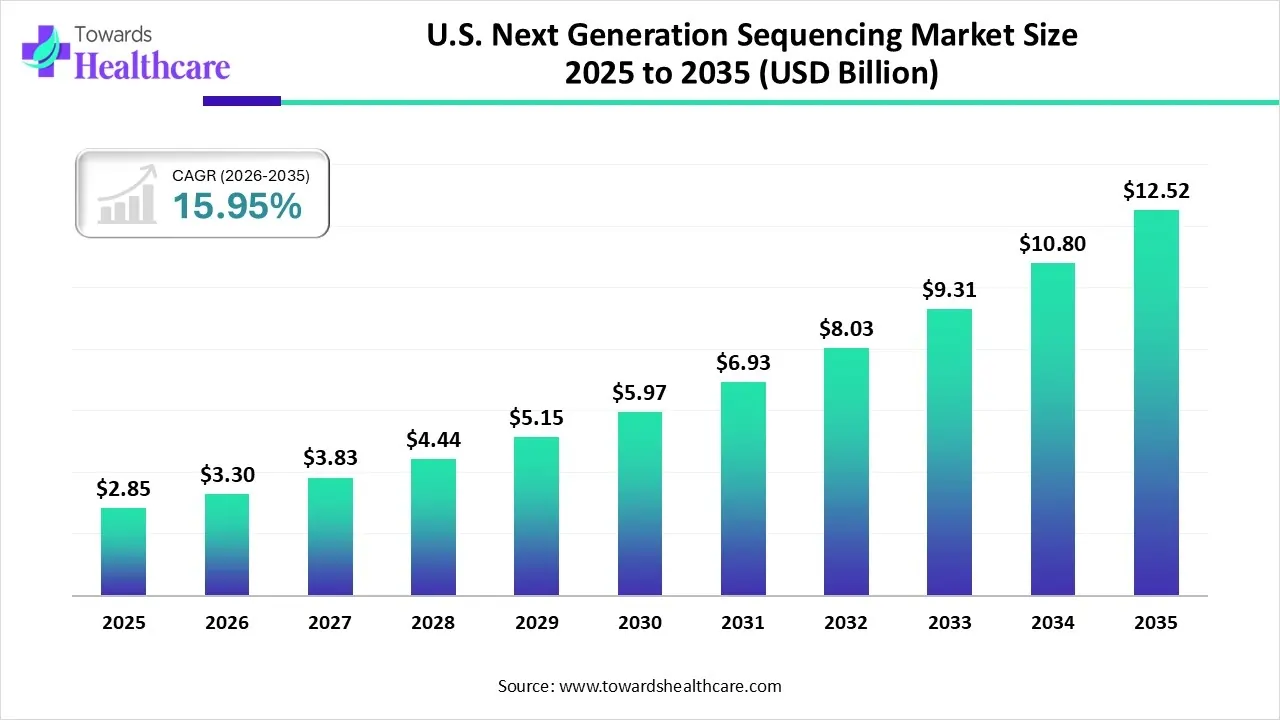

The U.S. next generation sequencing market size was valued at USD 2.85 billion in 2025 and is predicted to hit around USD 12.52 billion by 2035, rising at a 15.95% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 06, 2026 (GLOBE NEWSWIRE) -- The U.S. next generation sequencing market size is calculated at USD 3.3 billion in 2026 and is expected to reach around USD 12.52 billion by 2035, growing at a CAGR of 15.95% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6450

Key Takeaways

- The U.S. next generation sequencing industry is poised to reach USD 2.85 billion by 2025.

- Forecasted to grow to USD 12.52 billion by 2035.

- Expected to maintain a CAGR of 15.95% from 2026 to 2035.

- By product type, the sequencing instruments segment led with a major share of the market in 2024.

- By product type, the consumables & reagents segment is expected to grow at the fastest CAGR during 2025-2034.

- By application, the clinical diagnostics segment was dominant in the U.S. next generation sequencing market in 2024.

- By application, the drug discovery & development segment is expected to grow rapidly in the coming years.

- By end-user, the hospitals & diagnostic laboratories segment held the largest revenue share of the market in 2024.

- By end-user, the biopharmaceutical & CROs segment is expected to be the fastest-growing in the studied years.

- By sequencing type, the whole genome sequencing (WGS) segment dominated the market in 2024.

- By sequencing type, the exome sequencing segment is expected to witness rapid expansion during the forecast period.

- By technology, the sequencing by synthesis (SBS) segment registered dominance in the market in 2024.

- By technology, the solid-phase/other NGS technologies segment is expected to grow at the fastest CAGR during 2025-2034.

What are the Fostering Aspects in the U.S. Next Generation Sequencing?

Firstly, the U.S. next generation sequencing market is propelled by the rising demand for tailored medicines, with expanding technological breakthroughs, and increased applications in clinical diagnostics, like cancer, prenatal, with advanced research funding. However, day by day, the U.S. has been putting efforts into AI integration, ultra-fast/cost-effective platforms, such as Roche's SBX, Illumina's XLEAP, single-cell tech, and clinical execution.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drivers in the U.S. Next Generation Sequencing Market?

Primarily, many U.S. players are promoting prominent innovation in platforms (long-read, single-cell) to enhance speed, accuracy, and inexpensiveness, and minimizing prices to <$200/genome, which makes NGS highly accessible. Along with this, ongoing substantial U.S. government investment in genomics research (NIH, CDC) fuels adoption, and R&D is also impacting the comprehensive developments in the next-generation sequencing approaches.

What are the Substantial Trends in the U.S. Next Generation Sequencing Market?

- In December 2025, Illumina, Inc. and MyOme collaborated, and Illumina invested in MyOme to support advancing MyOme's strategic roadmap, such as MyOme's Proactive Health (MPH) Trial.

- In December 2025, Andhra Pradesh, Ipseity Diagnostics and Research, a U.S.-based molecular diagnostics company, collaborated with Vignan’s Foundation for Science, Technology and Research to achieve transcriptomics, affordable PCR technologies, and Next Generation Sequencing (NGS) in the State.

- In September 2025, Golden Helix partnered with Genomenon to integrate its Mastermind Genomic Intelligence Platform and Cancer Knowledgebase (CKB) into the Golden Helix software suite.

What is the Significant Challenge in the U.S. Next Generation Sequencing Market?

Many firms are facing a vast data complexity, which requires better bioinformatics, high initial spending & maintenance. As well as certain companies having a lack of skilled personnel, regulatory barriers, and ethical issues about data privacy, which restrict the broader clinical adoption despite rising demand.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By product type analysis

Which Product Type Led the U.S. Next Generation Sequencing Market in 2024?

In 2024, the sequencing instruments segment registered dominance in the market. The segmental growth is fueled by a rise in genetic/oncology incidences, government funding (NIH), and widening use in clinical diagnostics/personalized medicine, especially in cancer, rare diseases. A recent advancement includes Illumina NovaSeq X Series, a high-throughput system that offers excellent sequencing power with up to 16 terabases of data output, using new XLEAP-SBS chemistry for increased acceleration and fidelity.

Whereas the consumables & reagents segment will expand rapidly in the coming era. This mainly encompasses different kinds of library preparation kits, sequencing kits/reagents, like buffers, enzymes, adapters, beads and sequencer cartridges. An extensive development, like an updated EM-seq v2 kit for sensitive methylation detection by New England Biolabs (NEB), is impacting the entire progression. However, Meridian Bioscience presented a lyophilized NGS library prep kit to resolve cold chain requirements.

By application analysis

How did the Clinical Diagnostics Segment Dominate the Market in 2024?

The clinical diagnostics segment captured the biggest share of the U.S. next generation sequencing market in 2024. Specifically, NGS allows the identification of genetic mutations for precision cancer therapies (oncology) and accurate diagnosis of rare/inherited disorders. The market is putting efforts into liquid biopsies, long-read sequencing (PacBio, Nanopore) for complex variants, and integration of RNA sequencing for anticipating treatment response.

On the other hand, the drug discovery & development segment is predicted to witness the fastest growth. The U.S. is mainly focusing on precision oncology, rare diseases, and pharmacogenomics. Moreover, the FDA began Project Optimus, which promotes the contribution of genomics to clinical trial design for oncology drugs. Alongside, the FDA-approved MSK-IMPACT and FoundationOne CDx (F1CDx) tests are multiplex NGS panels employed for complete tumor profiling to guide treatment decisions.

By end-user analysis

What Made the Hospitals & Diagnostic Laboratories Segment Dominant in the Market in 2024?

The hospitals & diagnostic laboratories segment accounted for a major share of the U.S. next generation sequencing market in 2024. They prominently use NGS for comprehensive genomic profiling, liquid biopsies, prenatal testing, HLA typing, and guiding treatment for strengthening outcomes. For example, the New York Genome Center has a clinical diagnostic lab licensed to conduct whole-genome sequencing for undiagnosed diseases across all 50 U.S. states & RWJBarnabas Health and Cooperman Barnabas Medical Center perform in-house NGS.

Moreover, the biopharmaceutical & CROs segment is anticipated to register rapid expansion. Particularly, CROs GENEWIZ (an Azenta Life Sciences company) is facilitating a full suite of genomic services, comprising NGS, Sanger sequencing, and bioinformatics analysis, with multiple US locations. Along with this, Bio-Rad Laboratories is providing NGS library preparation kits and digital PCR systems for accurate quantification in research.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By sequencing type analysis

Why did the Whole Genome Sequencing (WGS) Segment Lead the Market in 2024?

The whole genome sequencing (WGS) segment held the dominating share of the market in 2024. This has a substantial application in rare disease diagnostics to detect mutations leading to inherited issues. Its prominent development is the first complete human genome and national adoption for pathogen surveillance by the CDC's PulseNet for bacteria, such as Salmonella and Listeria. Also, NIH's All of Us Research Program, a progressive U.S. effort, delivered hundreds of thousands of WGSs for precision medicine research.

The exome sequencing segment will expand at a rapid CAGR. Ongoing milestones include the professional bodies, especially the American College of Medical Genetics and Genomics (ACMG), which has developed guidelines for the clinical use of exome sequencing, such as recommendations for when it should be a first-line test and how to handle incidental findings. Besides this, Stanford Children's Health utilises exome sequencing to end "diagnostic odysseys" for patients with mysterious symptoms, such as epilepsy or congenital heart defects.

By technology analysis

Which Technology Dominated the U.S. Next Generation Sequencing Market in 2024?

In 2024, the sequencing by synthesis (SBS) segment captured the biggest share of the market. In the US, novel advances are being explored, including XLEAP-SBS chemistry for quicker, higher quality reads, NovaSeq X Series for huge throughput (up to 16 Tb), and compact platforms, especially the MiSeq i100 for rapid, simple benchtop runs, with CMOS-based systems. It has a major use in large-scale projects like sequencing thousands of human genomes affordable.

However, the solid-phase/other NGS technologies segment will expand rapidly. Recently, Roche's Sequencing by Expansion (SBX) technology, executed by Broad Clinical Labs, in collaboration with Roche, broke the Guinness World Record for the fastest DNA sequencing technique, fostering a human genome from sample to variant call file in under four hours. As well as Illumina also introduced its Protein Prep assay, an NGS-based proteomics platform to assist multiomics studies and promote drug discovery by enabling researchers to measure 9,500 human protein targets.

Regional Analysis

Which Factors Influence the U.S. Next Generation Sequencing Market?

Numerous factors influence market growth, including the increasing development of personalized medicines, favorable government support, and an evolving regulatory landscape. The FDA recently announced that it can approve personalized treatments for rare and deadly genetic diseases based on data from a handful of patients. The National Institute of Health (NIH) has established a new Genomics-enabled Learning Health System (gLHS) to identify and advance approaches for integrating genomic information into existing learning health systems.

The rising prevalence of genetic disorders, the growing geriatric population, and the increasing awareness of prenatal testing foster market growth. More than 30 million Americans are affected by over 7,000 rare diseases. The NCI reported that approximately 2 million women undergo NIPT in the U.S. annually. The number of Americans aged 65 years or older is projected to grow from 58 million in 2022 to 82 million by 2050.

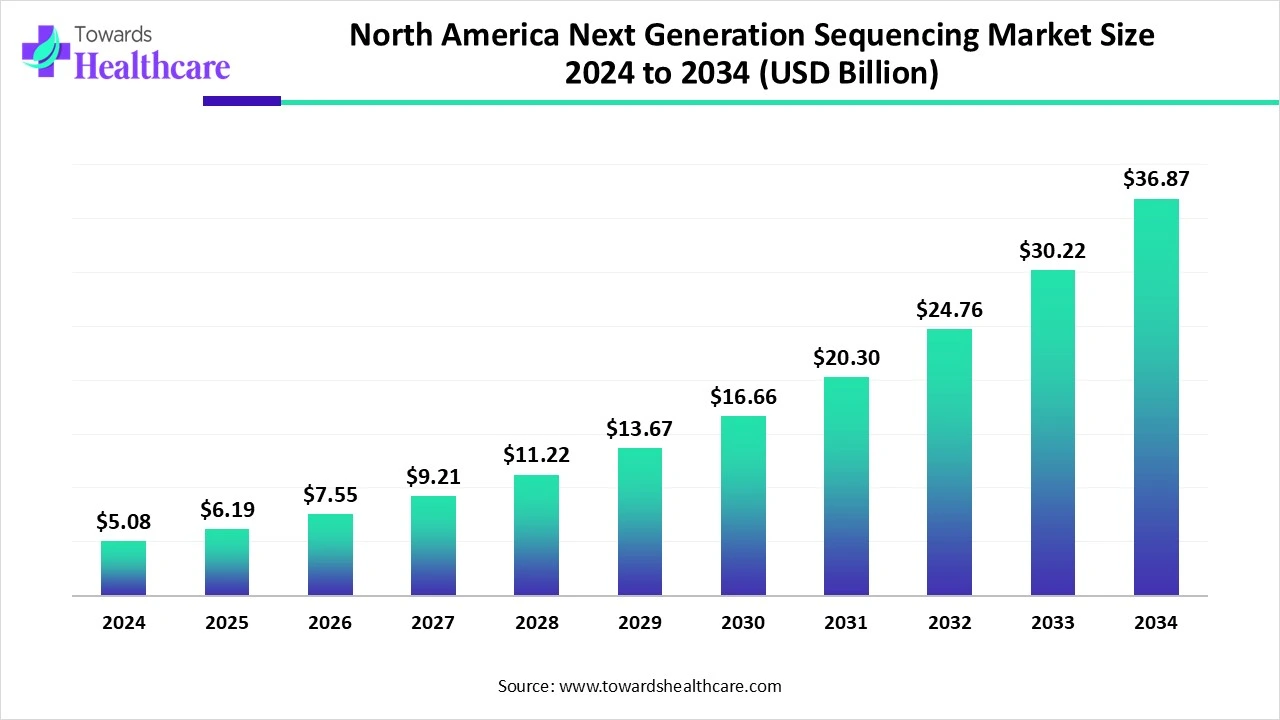

North America Next Generation Sequencing Market Size and Growth

The North America next generation sequencing market size is calculated at USD 5.08 in 2024, grew to USD 6.19 billion in 2025, and is projected to reach around USD 36.87 billion by 2034. The market is expanding at a CAGR of 21.93% between 2025 and 2034.

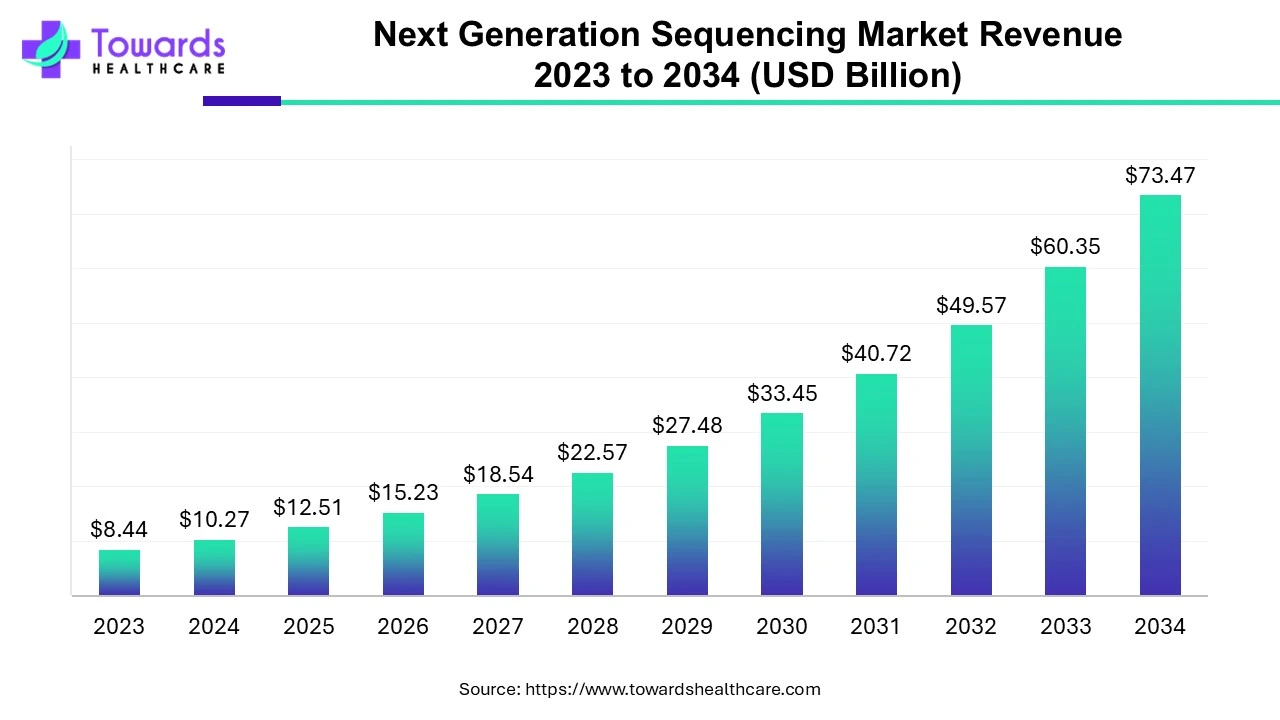

Next Generation Sequencing Market Size and Growth

The global next generation sequencing market size is calculated at US$ 10.27 billion in 2024, grew to US$ 12.51 billion in 2025, and is projected to reach around US$ 73.47 billion by 2034. The market is expanding at a CAGR of 21.74% between 2024 and 2034.

What are the Recent Developments in the U.S. Next Generation Sequencing Market?

- In October 2025, Takara Bio USA unveiled a series of updates to its product portfolio created to explore its new class of spatial technology for more researchers.

- In October 2025, GeneDx announced the launch of BEACONS (Building Evidence and Collaboration for GenOmics in Nationwide Newborn Screening), the nation’s foremost multi-state genomic newborn screening initiative.

- In September 2025, Beckman Coulter Diagnostics, a Danaher company, introduced the industry's first fully automated Brain-derived Tau (BD-Tau) research use only (RUO) immunoassay test.

U.S. Next Generation Sequencing Market Key Players List

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc

- PerkinElmer, Inc.

- Pacific Biosciences of California, Inc. (PacBio)

- 10x Genomics, Inc.

- New England BioLabs, Inc.

- Azenta US, Inc.

- Promega Corporation

- GenScript USA, Inc.

- BD (Becton, Dickinson and Company)

- Hamilton Company

- Clear Labs, Inc.

- Ultima Genomics, Inc.

- DNAnexus, Inc.

- Element Biosciences, Inc.

- Twist Bioscience Corporation

- NeoGenomics Laboratories, Inc.

Segments Covered in the Report

By Product Type

- Sequencing Instruments

- Benchtop Sequencers

- High-throughput/Next-gen Sequencers

- Consumables & Reagents

- Library Prep Kits

- Flow Cells & Chips

- Sequencing Reagents

- Software & Informatics Tools

- Data Analysis Software

- Genomic Interpretation Platforms

- Services

- NGS Sample Prep & Sequencing Services

- Contract Research/Clinical Sequencing Services

By Application

- Clinical Diagnostics

- Drug Discovery & Development

- Research & Academia

- Agrigenomics/Animal & Plant Genomics

- Other Applications

By End-User

- Hospitals & Diagnostic Laboratories

- Biopharmaceutical & CROs

- Academic & Research Institutes

- Government & Public Health Organizations

- Others

By Sequencing Type

- Whole Genome Sequencing (WGS)

- Exome Sequencing

- Targeted Sequencing

- RNA Sequencing

- Other Sequencing Types

By Technology

- Sequencing by Synthesis (SBS)

- Semiconductor/Ion Torrent

- Pyrosequencing

- Solid-phase/Other NGS Technologies

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6450

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.